Elements in this framework have been blurred for IP reasons. (and also encourage hiring managers to have a live session instead)

AI Advisory Platform: Re-imagining Financial Advisory

Skills Applied:

- Innovation Strategy

- AI/ML Integration

- UX Research & Testing

- Stakeholder Management

- Cross-functional Leadership

Income Insurance

2024

The challenge:

Traditional solutions need to scale effectively to meet the needs of advisors with the organization's growth. By harnessing the capabilities of artificial intelligence (AI) through models like ChatGPT, Income wanted to uncover which areas they could utilise increase advisor productivity while staying aligned with compliance on both corporate and national levels.

Evolution of Approach:

Initially, we focused purely on AI-powered knowledge retrieval. However, user research revealed a crucial insight: advisors needed more than just information—they needed context and confidence in their decisions.

Challenges

#1 Cross-functional ownership

The data science team was up to their eyes with technical requirements, preparing the existing documents to train the model, and ensuring accuracy and explainability. Hence requiring a collaborative effort from the experience team to uncover needs.

#2 Adaptive coaching

Coaching entails more than just reading product specs, and each person learns differently, with complexity added with the need to pitch to diverse age groups and characteristics.

#3 Promoting AI literacy

There is a preconceived notion among advisors that Gen AI is capable of doing “everything” and hence will trust all responses 100%. This uncovers another challenge to be addressed separately: raising AI literacy in the organisation.

Process

-

Led cross-functional workshops to identify AI integration opportunities in advisor workflows

Mapped current advisor pain points across 5 key journey touch-points

Led cross-functional workshops to identify AI integration opportunities in advisor workflows

Mapped current advisor pain points across 5 key journey interactions

-

Uncovered crucial insight: 70% of advisors needed contextual learning, not just information

Identified specific scenarios where AI could augment (not replace) human decision-making

Created rapid prototyping framework for testing AI-human interaction models

-

With reference from AI guidelines from tech companies and MAS, we synthesized insights from 10+ AI implementation case studies

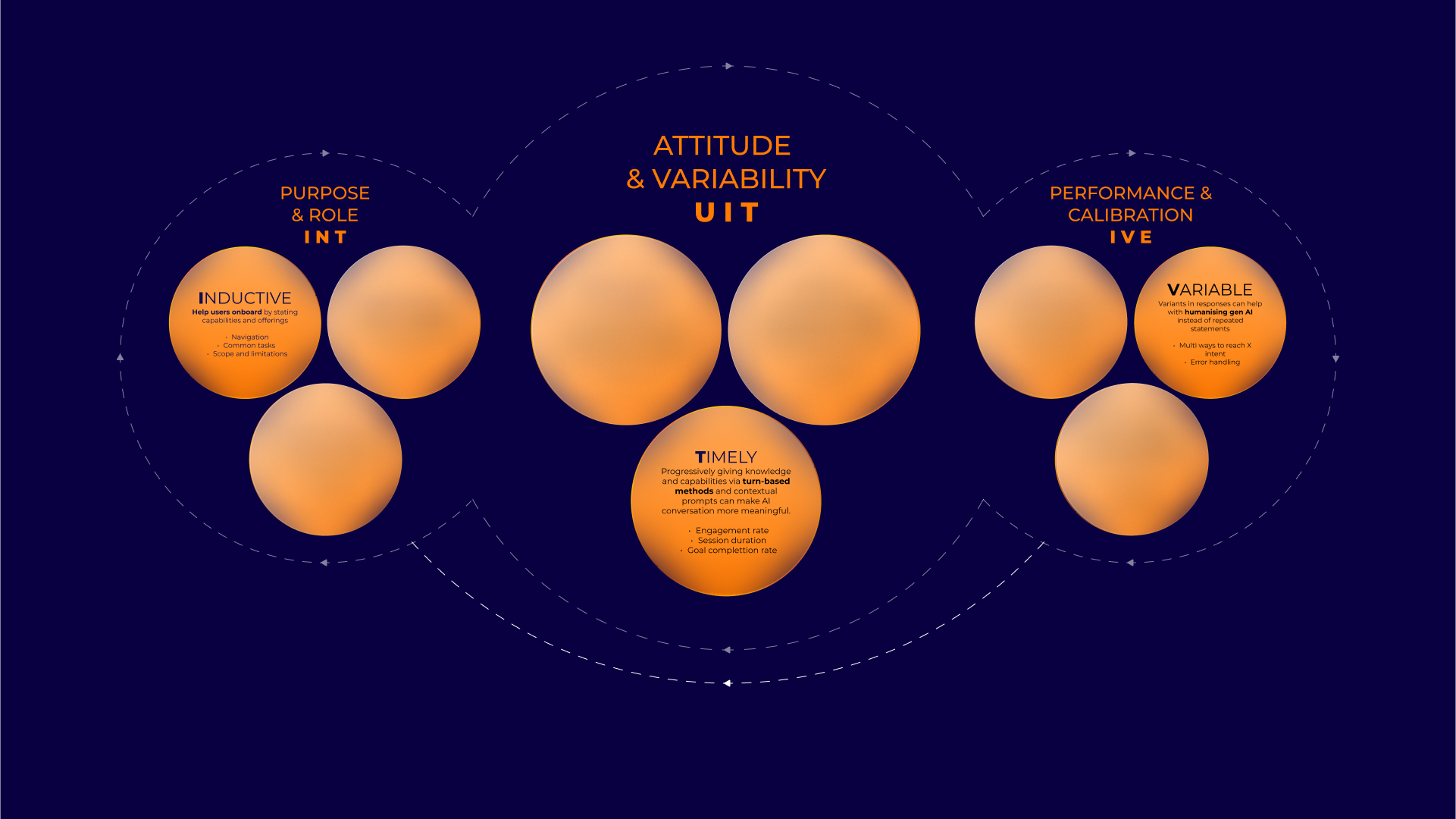

Created proprietary Human-Centered AI Framework focusing on:

Trust building mechanisms

Explanation capabilities

Error recovery patterns

Learning loop integration

-

Built consensus across business, tech, and compliance teams

Pivoted development approach based on early feedback:

Shifted from pure automation to augmented intelligence

Introduced progressive trust building features

Developed hybrid learning approaches

End result

-

Defining AI service roadmap and guidelines

Developed a features roadmap based on needs for 2025. Metrics are determined together with Data, risk and compliance team for further needs analysis. Created ethical AI guidelines that aligns with MAS FEAT principles

-

Experience (UX) matters more than ever

Responding with an answer is not sufficient, for investments, it is crucial to help users understand the last known date for knowledge update. This helps user to identify if the model should be the right source for the query at that moment.

-

Managing stakeholder expectation on AI products

One of the biggest concerns was balancing user recruitment for testing, red teaming and optimisation from stakeholders. It was crucial to share reasons behind to why such rigorous cycles are required compared to traditional digital products.